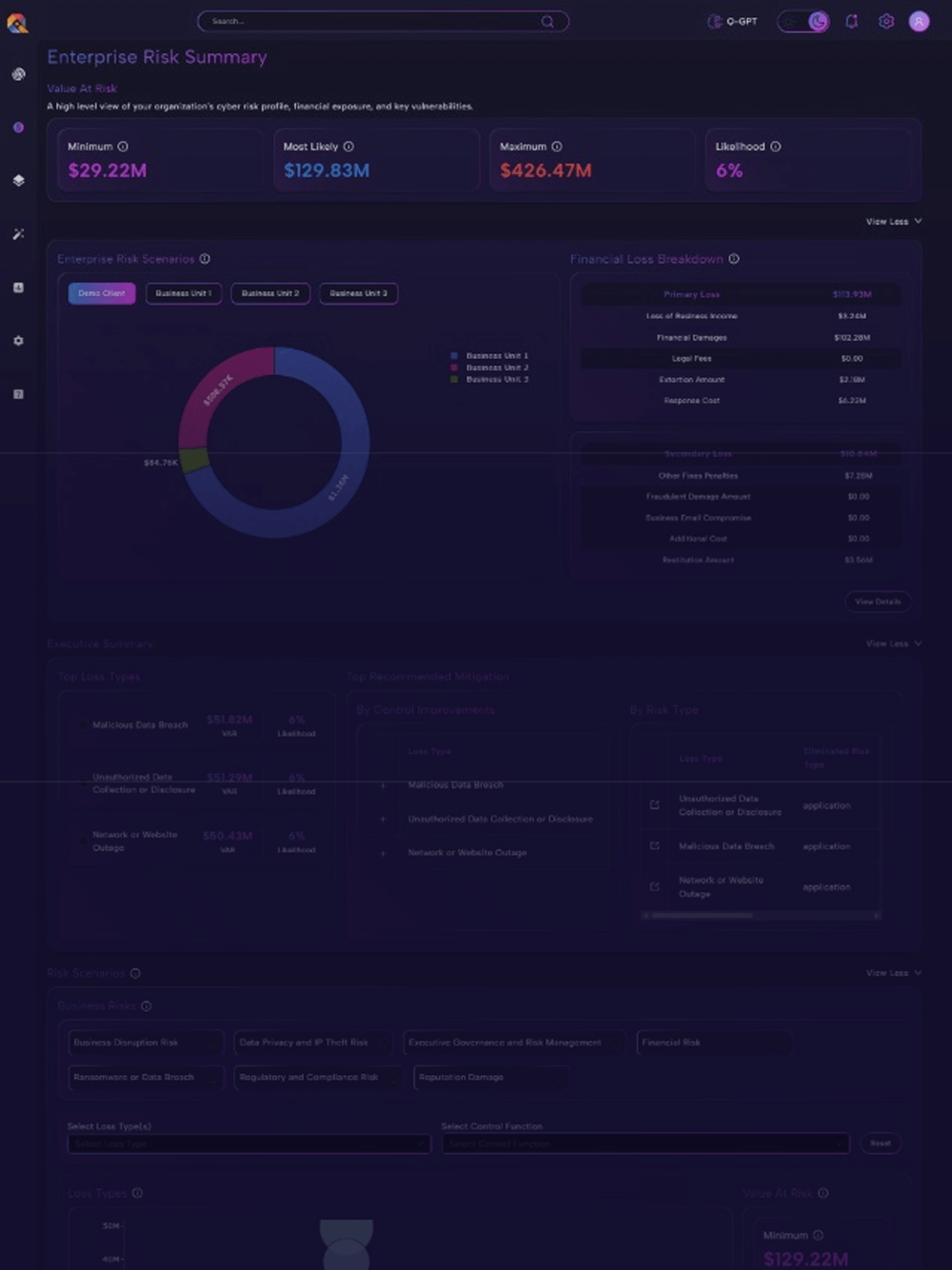

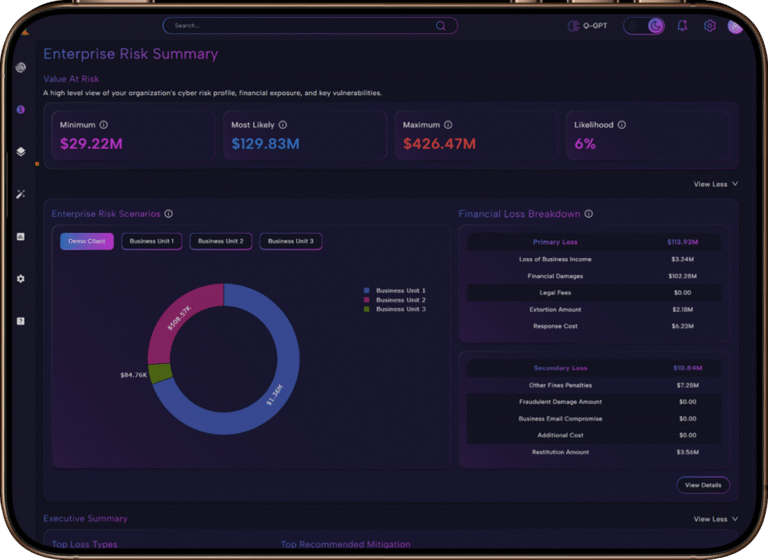

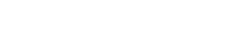

Dynamic Cyber Risk Quantification

Quantara AI pinpoints your top risk scenarios, quantifies their $VaR (Value at Risk), and prioritizes mitigations by ROI and most risk reduced per dollar—so you can make financially optimized, defensible decisions.

Key Capabilities

01

Defensible CRQ

Prove your $VaR with transparent and configurable models

02

ROI & RRI Proof

Justify spend with clear ROI & Risk Reduction Impact (RRI) in dollars

03

Dynamic Scenarios

Model risk by business unit & simulate "what-if" scenarios.

04

Mitigation Roadmap

Prioritize actions by ROI and measurable risk reduction.

How It Works

-

Connect & Unify

Seamlessly integrate cyber, business, and threat data for unified risk visibility. -

Correlate Exposure

Map Vulnerabilities, control maturity, threats, and loss trends (KEV, industry, business profile). -

Quantify Impact ($VaR)

Convert exposures into Value-at-Risk and residual risk using real-time threat and financial loss data. -

Recommend & Align

Prioritize mitigations by ROI and RRI, align to ERM frameworks, and publish board-ready insights.

Integrations

Use Cases & Benefits

-

Board & Executive Reporting

Quantify cyber risk in financial terms to guide investments with defensible, dollar-based reports. -

Cyber & IT Leadership (CISO, GRC, SecOps)

Shift from reactive to financial impact-driven security. Prioritize mitigation by ROI/RRI to prove measurable outcomes. -

Risk & Finance Teams (CFO, CRO, Risk Analysts)

Embed CRQ into ERM and SEC reporting to optimize spend with cyber insurance, and exposure with true business risk. -

Measured Outcomes

Operationalize and automate CRQ across your enterprise — cut costs by 60%, and deliver $VaR in under 14 days.

See Quantara AI in Action

Decide where every dollar reduces the most risk—confidently, defensibly, and fast.