Why Clear Cyber Risk Communication is a Must-Have for C-Suite Success

In today’s digital world, cyber risks permeate all aspects of modern business—across cloud infrastructure, IoT, AI, datacenters, SaaS platforms, and even emerging technologies like quantum computing. C-Suite and business leaders are increasingly alarmed by the relentless wave of cyber incidents making headlines weekly, costing organizations millions and harming their reputations.

Despite significant investments in cybersecurity, many organizations struggle to communicate cyber risk to executives a clear and actionable way. This is where Cyber Risk Conscience (CRC)™ framework comes in, translating cyber risks into financial metrics, adversarial motives, and industry-specific insights. CRC empowers leaders to make informed, proactive decisions that align with business goals, protect value, and drive growth. In today’s landscape, effective risk communication isn’t a luxury—it’s non-negotiable.

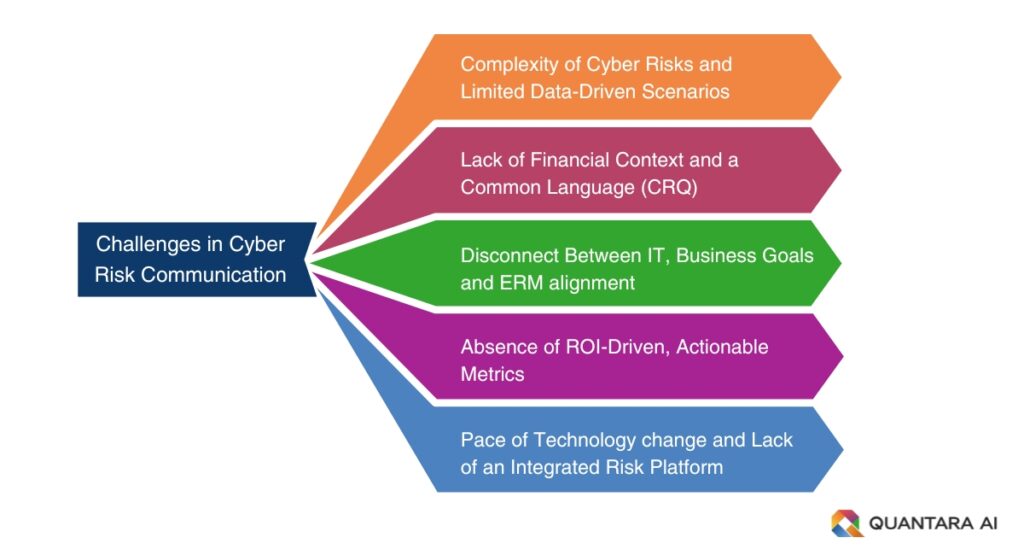

Essential Components of Effective Cyber Risk Communication

In today’s fast-evolving threat landscape, effective executive communication is crucial for managing cyber risk strategically. Quantara AI’s Cyber Risk Conscience (CRC)™ framework addresses this need by ensuring that cyber risk is communicated in a way that aligns with business objectives, Enterprise Risk Management (ERM) and resonates with executive leadership. Here are the five key elements of effective cyber risk communication and how CRC delivers on each:

1. Clarity and Simplicity

Communicate complex cyber threats in clear and simple language that business leaders can quickly understand. Executives must be able to grasp the urgency and impact of risks without getting lost in technical details. Simplifying technical information into dynamic, data-based business risk scenarios, allows leaders to make swift, informed decisions that align with organizational goals, ensuring that risk communication is meaningful and actionable.

CRC translates cybersecurity risks into ERM, and dynamic business risk scenarios that resonate with the C-suite, facilitating quicker and more effective decision-making.

2. Financial Impact Context and CRQ

Frame cyber risks in terms of their financial impact using Cyber Risk Quantification (CRQ). This ensures that risks are prioritized and understood in a business-relevant context. By understanding the potential financial losses associated with different threats, executives can allocate resources efficiently and justify cybersecurity investments.

CRC provides a Value at Risk in financial terms, enabling leaders to understand the ROI of mitigation strategies and make well-informed investment decisions.

3. Actionable, ROI-Based Insights and Dynamic Reporting

Provide actionable, data-driven insights that include financial simulation, ROI calculations and dynamic, role-based reports. This allows for strategic decision-making and proactive risk mitigation. A unified system that can generate automated, role-specific executive reports ensures that insights lead to targeted actions, such as risk transfer, new project safeguards, risk based operational improvements or strategic cyber insurance.

CRC offers dynamic reporting and ROI based prioritized recommendations tailored to different executive roles, ensuring that leaders can make proactive, high-impact decisions for risk reduction.

4. Alignment with ERM and Business Impact Analysis

Integrate cyber risk management with Enterprise Risk Management (ERM) and automate Business Impact Analysis to ensure a holistic approach to organizational risk. Aligning cyber risk with ERM frameworks ensures that all risk types are managed cohesively, supporting strategic initiatives and operational improvements. This also facilitates tracking the impact of risk mitigation efforts, like security investments or process changes.

CRC provides a dynamic view of cyber risk, aligned with ERM, and generates automated Business Impact Analysis to drive strategic decisions. Mitigation plans and progress tracking enable leaders to see the reduction in Value at Risk and the effectiveness of mitigation strategies.

5. Unified, End-to-End Risk Management System

Establish a centralized system that connects vulnerabilities, control gaps, threat intelligence, targeted loss magnitude data on your industry and size of the business. This system should support dynamic and role-based insights in business terms and support initiatives like risk transfer, new project risk assessments, and cyber insurance strategies. A unified approach ensures that cyber risk management isn’t fragmented but is instead a strategic enabler that connects security investments to business outcomes, enhancing governance and operational resilience.

CRC serves as a comprehensive platform for cyber risk management, offering automated, prioritized recommendations and mitigation plans.

Cyber Risk Governance

Embed risk communication into the organization’s overall executive and risk governance framework. A consistent communication cadence keeps all stakeholders informed and maintains cybersecurity as an ongoing focus rather than a one-time discussion. Effective governance ensures that cybersecurity is a strategic business function, with clear accountability and measurable outcomes.

CRC provides a governance framework with automated reporting, tracking the Risk Reduction Impact and enabling leaders to see how interventions decrease the organization’s Value at Risk over time.

Why is Regular Cyber Risk Communication Essential?

Regular communication on cyber risk is essential in setting a proactive and accountable tone across the organization. A single or inconsistent updates on cybersecurity status is no longer sufficient for a dynamic risk landscape; instead, ongoing communication keeps stakeholders informed about new vulnerabilities, threats, and the evolving cyber risk posture.

When executives effectively communicate cyber risk, they reinforce the organization’s commitment to security and resilience, both internally and externally. This clear, unified message reassures investors, clients, and stakeholders that leadership is actively managing potential threats. Consistent updates offer several key benefits:

Agility and Responsiveness: Regular risk communication allows executives to swiftly update stakeholders on emerging threats, such as new ransomware or phishing techniques, demonstrating vigilance and maintaining trust.

Increased Stakeholder Engagement: Frequent updates, like quarterly or monthly briefings, keep cyber risk top-of-mind, engaging board members and senior leaders in ongoing discussions and making cybersecurity a core part of strategic operations.

Confidence and Trust: Consistent communication builds transparency and accountability, reassuring investors and clients that the organization is proactive and committed to protecting assets and information.

Key Stakeholders in Executive Risk Communication

Effective risk communication is crucial for uniting stakeholders—from the Board to IT teams – in making informed, strategic decisions that protect the organization. Each stakeholder plays a pivotal role in translating cyber threats into actionable insights, ensuring alignment and proactive risk management.

Board of Directors: Oversee risk management strategy, integrate cyber risks into governance, and make strategic decisions for organizational protection.

C-Suite Executives (CEO, CFO, COO): Align cybersecurity with business objectives, allocate resources, and prioritize efforts to ensure resilience against threats.

Chief Information Security Officer (CISO): Communicate cyber risks to leadership, translate technical threats into business terms, and recommend mitigation strategies.

Chief Risk Officer (CRO): Integrate cyber risk into the enterprise risk framework for a cohesive approach to overall organizational risk.

IT and Security Teams: Assess threats, implement controls, and provide data for risk quantification to support informed executive decisions.

Compliance and Legal Teams: Ensure risk communication meets regulatory standards, advise on compliance issues, and minimize legal exposure.

Business Unit Leaders: Understand cyber risk impacts, collaborate on mitigation, and align security efforts with business operations.

Conclusion:

Establish Proactive Governance with Cyber Risk Communication

In today’s rapidly evolving digital world, AI-powered cyber threats are outpacing traditional defenses, making reactive strategies dangerously inadequate. Infrequent cybersecurity update simply won’t cut it anymore – ongoing, clear communication is essential to keep leaders informed about emerging vulnerabilities, threats and the evolving risk landscape. Cyber risk is now a Board-level issue, and the urgency to transform how organizations communicate, prioritize, and mitigate these threats has never been greater.

Quantara AI: The Future of Cyber Risk Governance

Quantara AI is redefining cyber risk governance for this era of constant change. With real-time insights, financial impact, ROI analysis, and dynamic, role-specific reports, CRC empowers leaders to align cybersecurity with business priorities and make proactive, high-ROI decisions. By unifying risk management across IT, business, and executive teams, Quantara AI turns cybersecurity from a defensive necessity into a strategic advantage.

Get Started and Schedule a Demo and discover how Quantara AI can transform your cybersecurity strategy, turning risk management into a strategic business enabler.

Follow Quantara AI on LinkedIn for the latest updates, expert advice, and trends in cyber risk quantification and management. Stay ahead of emerging threats with us!